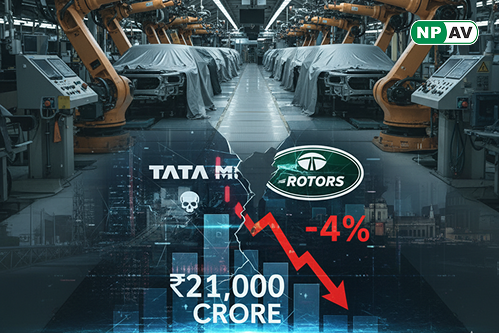

Jaguar Land Rover Cyberattack Halts Production: Tata Motors Shares Plunge 4% Amid ₹21,000 Crore Loss Risk

Tata Motors' shares fell nearly 4% on the Bombay Stock Exchange, hitting an intraday low of ₹655.30 on September 25, 2025, after a major cyberattack targeted its British luxury subsidiary, Jaguar Land Rover (JLR). The breach could result in losses exceeding ₹21,000 crore (2 billion pounds), surpassing JLR's ₹18,900 crore fiscal profit, and was worsened by the company's inability to finalize cyber insurance negotiations beforehand, exposing it to substantial financial risks.

JLR has extended production shutdowns until October 1, initially paused until September 24, leading to estimated weekly losses of ₹560 crore (50 million pounds) and sending 33,000 employees home while IT systems and production lines are restored. With JLR driving about 70% of Tata Motors' revenue, the attack has heightened investor worries about earnings and supply chain disruptions in the automotive industry.

Analysts, including Rajat Agarwal, highlight the auto sector's growing digital vulnerabilities, urging enhanced security measures across operations. Cyber expert Professor Triveni Singh views the incident as a national economic threat, advocating for cyber insurance and robust IT infrastructure as core governance priorities, especially as the global shift to electric and connected vehicles intensifies cyber risks.

NPAV offers a robust solution to combat cyber fraud. Protect yourself with our top-tier security product, Z Plus Security